FINANCIAL FRAUD: HITTING WHERE IT HURTS

August 4, 2016

It’s a classic Hollywood theme: loveable rogue scams unwitting victims and makes off with their hard-earned funds to enjoy a lifestyle of luxury. It’s an entertaining story-line, but if it happens to you in real life, the financial and emotional impact can be huge.

What is financial fraud?

Financial fraud is often referred to as “white collar crime” and usually occurs when an individual in a position of power or trust steals money for personal gain. They can cause financial ruin, destroy businesses and break up families.

Due to advances in technology, individuals have become more susceptible to fraud and the complexity of fraud scams can be difficult for expert investors to identify.

Financial fraud includes:

- Forging or dishonestly changing documents.

- Misuse of funds, including credit card fraud.

- Breach of trust and identity theft.

- Scams.

Some recent high profile examples of fraud include:

- A woman controlled funds on behalf of people who could not make their own financial decisions. She spent the money on shopping sprees, plastic surgery and holidays. She was found guilty of fraud, but the funds could not be recovered.

- A director of a company was able to falsify documents leading to substantial losses for hundreds of people. He had used the funds to pay the company’s debts.

- A married couple created an elaborate property investment scam, promising high investment returns. They used the funds to buy luxury cars and pay off their mortgage.

The statistics

Instances of financial fraud are on the rise. In 2012, the ACCC received almost 84,000 scam-related complaints from consumers and businesses, with financial losses totalling $93 million.

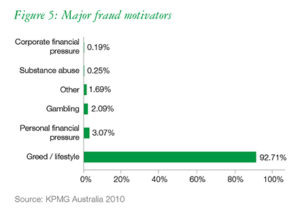

Greed and lifestyle appear to be major fraud motivators, as this table indicates:

What to do if it happens to you

If you believe that you have been defrauded, it is important to seek urgent legal advice from an experienced fraud litigation lawyer.

You should also report the matter to the police, but bear in mind that it may take months or even years before there is a criminal trial. Sometimes, police may decide to drop the charges, or prosecutors may decide not to take the matter to trial. If this happens, the fraudster may never be punished. You may never get your money back as it is becoming easier for a fraudster to transfer, launder and syphon funds to international accounts, convert funds to assets or transfer funds to third parties.

For this reason, if you have been defrauded, immediate legal action should be taken to freeze the assets of the fraudster to prevent any further spending.

Taking legal action

Even if the police decide not to pursue the matter, you have the option of suing the fraudster for damages. This is known as taking civil action. The aim is to get a court order that the fraudster repay you some or all of the money that you have lost. You should carefully discuss this option with your lawyer.

Civil action can also be faster than criminal proceedings. A court may be available to hear an application for a freezing order within a matter of days. Sometimes, a civil trial can be heard within a few months.

How a fraud matter impacts on you can often come down to timing. The sooner you take action, the greater the chance that you will recover at least some of your assets or recover the value of the assets with a civil claim.

Websters Lawyers are experienced in acting for people who have been defrauded and have achieved great results for some clients. Contact us today for advice about your situation and whether you might succeed in a claim against a fraudster.